Ready or Not, AI Workflow Automation is Here to Stay

Gokul Rangarajan

4 postsPitchworks VC Studio , Investing and building on Healthcare and Productivity

The AI economy is revolutionizing business operations from the shop floor to the C-suite. As companies adopt digital-first strategies, AI workflow automation enables IT teams to do more with less. According to Gartner, by 2024, organizations will reduce operational costs by 30% by integrating hyperautomation technologies with redesigned operational processes.

Yet, many businesses have barely scratched the surface of AI automation’s potential. By embracing AI workflow automation, companies can unlock agility, efficiency, and economies of scale. This blog explores strategies, insights, and real-world scenarios that highlight the transformative power of AI workflow automation.

What is AI Workflow Automation?

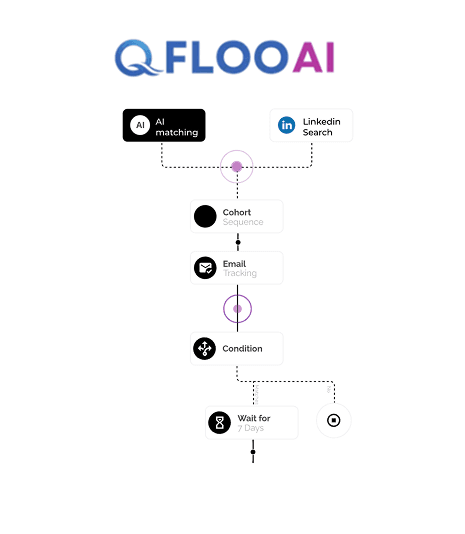

AI workflow automation uses artificial intelligence to streamline repetitive tasks, improving efficiency and productivity. Beyond simple automation, AI-driven workflow orchestration integrates digital tools like robotic process automation (RPA), APIs, and software robots. This allows businesses to create a mixed-autonomy model where technology, data, and human workers complement each other for optimal outcomes.

Scenario: AI-Powered Procurement Workflow

CFO Sarah notices procurement delays due to manual approval processes. With AI workflow automation, purchase requests are now validated against budgets in real time, automatically routed to the correct approvers, and processed within minutes—saving days of manual work.

How AI Workflow Automation is Transforming Business

AI workflow automation doesn’t just replace manual tasks; it enhances decision-making by leveraging machine learning, predictive analytics, and intelligent algorithms. Unlike traditional automation, AI-driven systems learn from data over time, making operations smarter and more efficient.

Scenario: CFO Dashboard Automation

CFOs often spend hours gathering financial reports from different departments. AI automation consolidates real-time financial data into a single dashboard, offering instant insights into cash flow, expenses, and revenue trends—enabling proactive financial planning.

AI and BPM: A Perfect Match for Workflow Optimization

Traditional business process management (BPM) structures workflows, while AI automation optimizes and executes them dynamically.

Scenario: AI-Driven Financial Compliance

A financial institution integrates AI into its BPM framework to automate compliance reporting. Instead of manually compiling reports, AI scans transactions, flags anomalies, and generates reports in minutes—ensuring regulatory compliance effortlessly.

AI Workflow Automation Use Cases for CFOs and Finance Teams

1. Automated Expense Management

CFO Mark’s team struggles with manual expense approvals. AI automatically categorizes expenses, flags policy violations, and processes reimbursements in real time—freeing finance teams from tedious tasks.

2. AI-Powered Fraud Detection

AI-driven fraud detection systems monitor transactions 24/7, flagging unusual spending patterns and preventing fraudulent activities before they escalate.

3. AI-Driven Accounts Payable Automation

Vendor invoice processing used to take days. AI bots now read invoices, match them with POs, and process payments autonomously—reducing cycle time by 70%.

Beyond Finance: AI Workflow Automation in Healthcare and Banking

AI in Healthcare Operations

- AI-Driven Patient Scheduling: Reduces wait times by 50% while optimizing hospital resources.

- Automated Medical Billing: AI ensures accurate claims submission, reducing errors and accelerating reimbursements.

AI in Financial Services

- AI-Powered Chatbots: AI-driven virtual assistants handle customer inquiries, reducing wait times and improving service quality.

- Automated Loan Processing: AI evaluates creditworthiness instantly, reducing approval times from days to minutes.

Challenges and Solutions in AI Workflow Automation

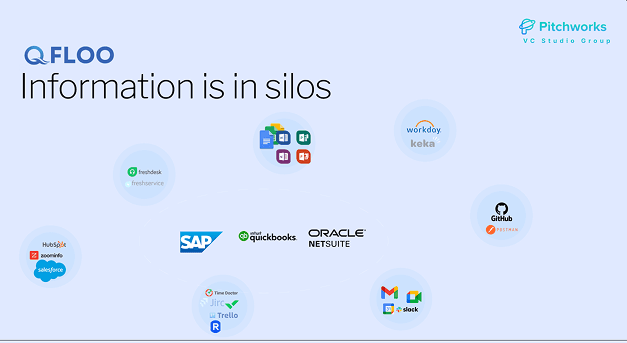

Despite its advantages, AI workflow automation comes with challenges:

- High IT maintenance costs

- Lack of skilled resources

- Complex integrations

- Overlapping tools and governance misalignment

Solution: Unified AI Automation Platforms

By adopting centralized AI-powered workflow platforms, businesses can reduce IT overhead, integrate systems seamlessly, and improve efficiency.

4 Key AI Workflow Automation Trends for 2024

- Intelligent Document Processing (IDP): AI-driven automation extracts data from documents with 99% accuracy.

- AI Copilots for CFOs: AI-powered assistants help CFOs make data-driven decisions effortlessly.

- Generative AI in Customer Experience: AI customizes interactions, boosting engagement.

- Hyperautomation: AI automates entire workflows, reducing operational costs significantly.

5 Best Practices for AI Workflow Automation

1. Assess Current Workflows

Identify bottlenecks before automating processes.

2. Ensure Seamless Data Integration

Reliable AI automation requires integrated, structured data.

3. Choose the Right AI Tools

Match AI capabilities with business needs.

4. Include External Stakeholders

AI workflows should seamlessly integrate with vendors, partners, and customers.

5. Continuously Optimize AI Workflows

Business needs evolve—AI workflows should, too.

Final Thoughts: AI Workflow Automation is a Necessity, Not an Option

To stay competitive, businesses must embrace AI workflow automation. By integrating AI into financial operations and business processes, CFOs and IT leaders can reduce costs, improve efficiency, and drive business growth.

Are You Ready for the AI-Powered Future?

AI workflow automation isn’t about replacing jobs—it’s about enhancing decision-making and efficiency. The future is now—how will you adapt?