NBFCs in India: The Hidden Data Crisis Costing Millions and How QFloo AI can help

Gokul Rangarajan

4 postsPitchworks VC Studio , Investing and building on Healthcare and Productivity

The Silent Crisis in India's NBFC Sector

India’s Non-Banking Financial Companies (NBFCs) manage assets worth ₹54 lakh crores, accounting for 25% of the total banking sector. These institutions play a crucial role in lending, yet behind the scenes, many are drowning in operational inefficiencies.

One of the biggest challenges? Data fragmentation. NBFCs spend over 100+ hours daily just consolidating reports from multiple branches. This inefficiency leads to delays in decision-making, compliance risks, and missed financial insights—all while dealing with rising regulatory scrutiny and tightening liquidity conditions.

Adding to the pressure, asset growth is projected to slow to 15-17% in FY25, a sharp decline from 23% in FY24. With rising delinquencies and an increasing focus on digital transformation, NBFCs cannot afford to operate with outdated, manual data processes.

The question is: why is data still a roadblock in an industry built on financial intelligence? More importantly, how can AI-driven automation solve this growing problem? Let’s explore.

In India, NBFCs are classified into different types based on their business activities and regulatory structure. Here are the key categories:

India’s NBFC sector is diverse, with Deposit-Taking (NBFC-D) entities like Shriram Finance and Non-Deposit-Taking (NBFC-ND) firms like Bajaj Finance leading the industry. Systemically Important NBFCs (NBFC-ND-SI), such as Mahindra Finance, manage ₹500+ crore in assets, making them crucial to financial stability. Other categories include Investment & Credit Companies (NBFC-ICC) (Muthoot Finance), Infrastructure Finance (NBFC-IFC) (Power Finance Corp), and Microfinance Institutions (NBFC-MFI) (CreditAccess Grameen), which serve rural and low-income borrowers. Housing Finance (NBFC-HFC) (HDFC Ltd) and Leasing & Hire Purchase firms (Cholamandalam) focus on real estate and vehicle financing. Emerging players include Factoring NBFCs (SBI Global Factors) and Peer-to-Peer Lending platforms (NBFC-P2P) like Faircent. While large NBFCs operate through extensive physical branch networks, many new-age players, especially digital lenders and microfinance institutions, function purely online. Despite RBI’s push for formalization, a significant portion of NBFC activity remains unorganized, particularly in rural lending, informal credit markets, and microfinance.

https://youtube.com/shorts/owto8l3z98c?feature=share

Challenges Faced by NBFCs in India

1️⃣ Regulatory Uncertainty – Frequent RBI policy changes make compliance difficult.

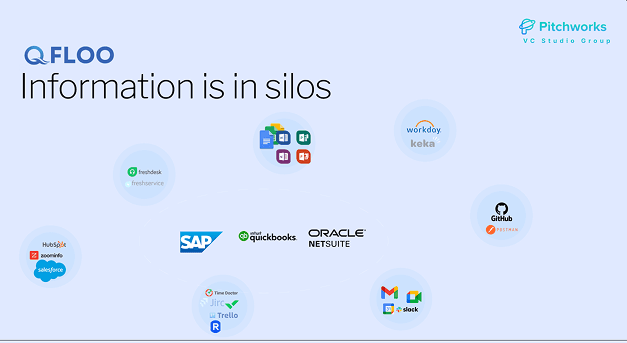

2️⃣ Scattered & Unstructured Data – Many NBFCs operate across multiple branches without a unified system, leading to inefficiencies.

3️⃣ High NPA Levels – Rising bad loans due to defaults, especially in MSME and rural lending.

4️⃣ Liquidity Crisis – Limited access to stable funding sources compared to banks, leading to cash flow issues.

5️⃣ Compliance & Audits – Stricter KYC, risk management, and capital adequacy norms increase operational burdens.

6️⃣ Cybersecurity Risks – Growing digital transactions make NBFCs vulnerable to fraud and data breaches.

7️⃣ High Operational Costs – Managing multiple physical branches increases expenses, especially for traditional NBFCs.

8️⃣ Lack of Real-Time Insights – Manual data consolidation delays decision-making, impacting efficiency.

9️⃣ Competition from Digital Lenders – Fintech startups and digital-first NBFCs are disrupting the industry with instant credit solutions.

Revolutionizing Financial Management with AI

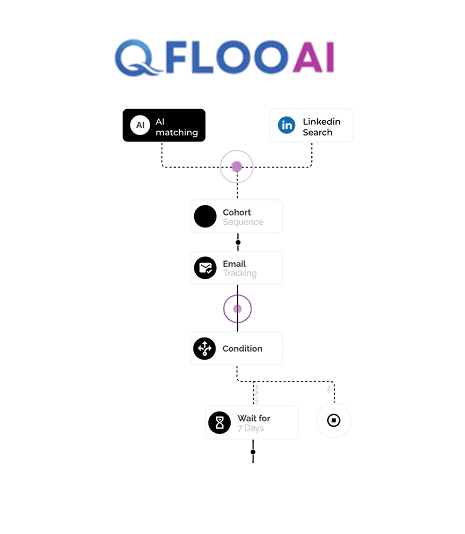

The best user interface is no interface—a philosophy that eliminates the need for new software learning while seamlessly integrating AI-powered automation into existing financial processes. Organizations no longer need to disrupt their workflows to implement cutting-edge AI solutions. Our Custom AI Large Language Model (LLM) Implementation works within private intranet systems or internal services, ensuring security, compliance, and ease of adoption. This approach enables enterprises to streamline financial asset and cash flow management without the complexities of traditional software deployment.

Zero Learning Curve & No Workflow Disruptions

Unlike conventional software that requires extensive onboarding and training, our AI solution is designed to integrate seamlessly with existing systems and processes. Employees can continue their daily operations without adapting to new platforms or learning additional tools. The AI agents work in the background, automating key financial functions while ensuring a faster incremental implementation. This means that organizations can gradually adopt AI automation without major overhauls, reducing friction and maximizing efficiency.

Scalable & Secure On-Premise Implementation

Scalability is a core aspect of financial AI automation. Our solution is built to expand across multiple teams and departments, ensuring uniform adoption across the enterprise. Moreover, security is a top priority, as our AI operates on-premise within the organization's private infrastructure. Unlike cloud-based solutions, no data is stored on vendor software, ensuring that sensitive financial information remains confidential and fully controlled by the enterprise. This level of security is crucial for banking institutions and large organizations dealing with high-value financial transactions.

AI Agents Automating Core Financial Functions

AI-driven automation transforms financial operations by enhancing decision-making and eliminating manual tasks. One of the key applications is in loan approvals, where AI algorithms analyze risk factors, assess borrower profiles, and automate approval processes based on predefined parameters. Similarly, cash flow monitoring becomes effortless as AI continuously tracks incoming and outgoing transactions, providing real-time insights into financial health. Additionally, automated deposit renewals ensure that investments are optimized for maximum returns, reducing the burden on financial teams and minimizing human errors.

Smart Task Management & Employee Productivity Tracking

Beyond financial automation, AI plays a crucial role in task management and employee productivity tracking. Organizations can leverage AI agents to assign tasks dynamically, ensuring that workloads are evenly distributed and prioritized based on urgency. Employee log hours are automatically recorded, enabling organizations to analyze work patterns and optimize resource allocation. This functionality enhances productivity by providing data-driven insights into employee performance and workflow efficiency.

Seamless Integration with Existing Systems

Our AI solution is designed to integrate effortlessly with existing enterprise platforms, ensuring a smooth transition to automation. The Core Banking System is directly linked to AI agents, enabling real-time access to loan and deposit data. AI also integrates with support and helpdesk platforms such as Freshdesk and Zoho Help, allowing for automated query resolution and enhanced customer support experiences.

Additionally, project management tools like Trello, Kwapio, and Time Doctor are connected to provide a centralized view of workloads, enabling managers to track project progress and employee efficiency. At the branch level, financial performance is monitored through Tally integration, ensuring real-time oversight of financial transactions and profitability metrics.

Collaboration & Communication Enhancements

In a modern workplace, effective collaboration is key to operational success. AI integrates with Meet, Gmail, and Slack, ensuring seamless communication across teams. Whether it's automated meeting scheduling, AI-driven email responses, or intelligent message prioritization, this integration enhances team efficiency while reducing administrative overhead.

Furthermore, Customer Relationship Management (CRM) systems such as Kwapio benefit from AI-powered insights. Customer profiles, relationship history, and engagement analytics are refined, allowing businesses to deliver personalized interactions and improve client retention.

Comprehensive Financial Data Consolidation

One of the biggest challenges in financial management is data fragmentation across multiple platforms. Our AI solution consolidates expense reports, revenue data, P&L statements, and financial insights into a single, unified dashboard. Excel sheets, financial reports, and transaction logs are automatically refined and structured, making it easier for decision-makers to access accurate, real-time financial intelligence. This consolidation eliminates redundancy, improves accuracy, and empowers organizations to make data-driven financial decisions with confidence

COO-Level AI Dashboard – Powered by Qfloo AI

The Qfloo AI-powered COO dashboard delivers a fully automated, real-time financial and operational overview, enabling leadership teams to make data-driven decisions without manual intervention. By seamlessly integrating with enterprise data sources, the dashboard provides a comprehensive view of total asset value, liquidity coverage, branch-wise performance, asset allocation, loan approvals, NPA rates, and operational efficiency. This AI-driven system ensures that financial leaders have instant access to critical business insights, helping them optimize resources, mitigate risks, and improve overall financial health.

The dashboard automatically consolidates and updates total asset value by classifying assets into secured and unsecured categories, short-term and long-term holdings, and risk-adjusted returns. By tracking these parameters in real time, Qfloo AI provides a dynamic portfolio overview that highlights potential growth areas and optimizes resource allocation. Additionally, the system continuously monitors total liquidity coverage, ensuring compliance with regulatory liquidity ratios while offering proactive recommendations to address shortfalls before they become critical.

Branch-level performance is another crucial aspect of the Qfloo AI dashboard. It provides a holistic performance analysis of each branch, tracking revenue, expenses, and profitability while identifying high-performing and underperforming locations. By leveraging AI-powered analytics, the system uncovers inefficiencies, allowing leadership to take targeted actions that drive growth. The asset allocation module further enhances strategic decision-making by dynamically distributing financial resources across various branches and investment categories, ensuring that capital is deployed in the most effective manner.

Loan approvals and rejections are also closely monitored, with AI analyzing historical approval trends and identifying patterns that impact lending efficiency. The system automatically detects common reasons for loan rejections and suggests adjustments in credit policies to optimize approval rates without increasing risk exposure. In addition, Non-Performing Asset (NPA) rates are tracked at a branch level, with AI-driven risk models predicting potential defaults before they occur. By continuously assessing risk scores, the dashboard helps financial institutions take preventive measures to reduce bad debt and improve loan recovery.

With real-time visibility into branch-wise asset value and liquidity coverage, financial leaders can make informed decisions about capital allocation. Qfloo AI ensures that branches operate with optimal liquidity while preventing funding imbalances that could affect operations. The dashboard also measures operational efficiency, analyzing cost-to-income ratios, employee productivity, and workflow effectiveness to identify areas for process improvement.

The system further enhances decision-making by analyzing branch-wise loan performance, helping executives assess repayment trends and detect early warning signs of defaults. By integrating with core banking systems, Qfloo AI streamlines loan processing times, identifying inefficiencies in the approval pipeline and suggesting AI-powered automation to expedite approvals. This results in faster loan disbursals, improved customer satisfaction, and enhanced revenue generation.

In addition to branch-level insights, the dashboard provides a granular view of product-wise Return on Investment (ROI) and default rates. By leveraging machine learning, it identifies the most profitable financial products while flagging those with high default risks. Predictive AI models further refine risk assessments, enabling financial institutions to adjust pricing strategies and lending policies accordingly.

Qfloo AI transforms the traditional COO dashboard into an intelligent, self-updating system that eliminates manual data collection and enhances strategic decision-making. With real-time insights, predictive intelligence, and seamless enterprise integration, this AI-powered solution empowers financial leaders to drive operational efficiency, reduce risks, and optimize profitability with confidence.

The Qfloo AI-powered recommendations engine enables financial institutions to make data-driven decisions across key leadership roles, ensuring sustainable growth, risk mitigation, and operational efficiency. These AI-generated insights provide real-time, actionable strategies for the COO, CFO, CRO, and General Manager, allowing them to optimize resources, enhance profitability, and improve customer satisfaction.

For COOs, the system recommends increasing jewel loan allocation by ₹10 Cr to capitalize on the high liquidity and low default rates of secured loans. Additionally, it suggests reducing fixed deposit rates by 0.5% to manage cost of funds efficiently while maintaining depositors' trust. Growth-focused recommendations include expanding high-margin loan products by 15% and increasing the branch network by 10 locations, ensuring wider market reach. AI also detects untapped potential, advising institutions to focus on rural market penetration, where financial inclusion can drive long-term profitability.

From a CFO perspective, the dashboard prioritizes financial stability and efficiency, recommending a 5% rebalancing of high-risk to low-risk assets to maintain a healthy risk-return balance. It suggests increasing cash reserves by ₹5 Cr to strengthen liquidity buffers while lowering operating costs by 8% through automation and process optimization. By optimizing fund allocation and increasing working capital buffers by ₹3 Cr, the recommendations help institutions enhance financial resilience and manage unforeseen disruptions.

For CROs, risk mitigation remains a core focus. The AI engine proposes reducing NPA exposure by 1.5% through proactive monitoring and strengthening loan recovery measures to improve collections. It emphasizes the need to enhance credit monitoring systems, ensuring early detection of risky borrowers. Additionally, it suggests lowering the default rate by 0.8% through data-driven underwriting strategies and increasing fraud detection measures, safeguarding the institution against financial crimes.

The General Manager’s recommendations emphasize operational excellence and customer experience. AI identifies opportunities to improve branch-level efficiency and increase customer satisfaction by 10% by streamlining service delivery. To eliminate inefficiencies, it advises institutions to reduce operational bottlenecks and launch a new product line in Q4 based on market demand trends. Additionally, investing in talent development is crucial, leading to the recommendation of increasing the employee training budget for enhanced service quality.

With these AI-powered strategic insights, financial institutions can accelerate decision-making, enhance risk management, and drive sustainable growth with minimal manual intervention.